With the kind of growth that has been noticed with coworking space, it can’t be a surprise to see that why commercial real estate investors are investing in coworking space.

Landlords and property managers are aware of the fact that a coworking space will add value to their building along with a good return on investment. Coworking and shared workspaces giving more attention to the hospitality of their service. To become successful in this industry, the operator needs to focus on providing some different and unique services to the members so as to attract and retain them.

Providing members with different kinds of perks can always turn out to be beneficial for the company. People around are ready to pay extra for a good experience. Since the coworking operators are running the show it is the property owners who realize that they can monetize and benefit from the trend.

Coworking or shared offices have become vital for various groups of professionals. From entrepreneurs running a one-man show to large companies investing in shared offices. Coworking space has been expanding in all directions and locations. Refer to the financial model of co-working space to give more detailed information about financing a coworking space.

With the kind of trend and profitability coworking space has been gaining the commercial real estate investors are more interested in renting the space to a coworking operator. A dedicated property manager would be competent enough to handle the requirements of running a coworking space.

The current market value for coworking is estimated to be about $5-10 billion which is not even close to 1% of the value of the CRE industry. The real estate industry holds a value of about $12 Trillion. There is a possibility that the coworking industry may be taken over by the big players in the CRE industry. This is just an assumption that can be based. No such thing has yet to be seen.

Property owners concept of investing in coworking space

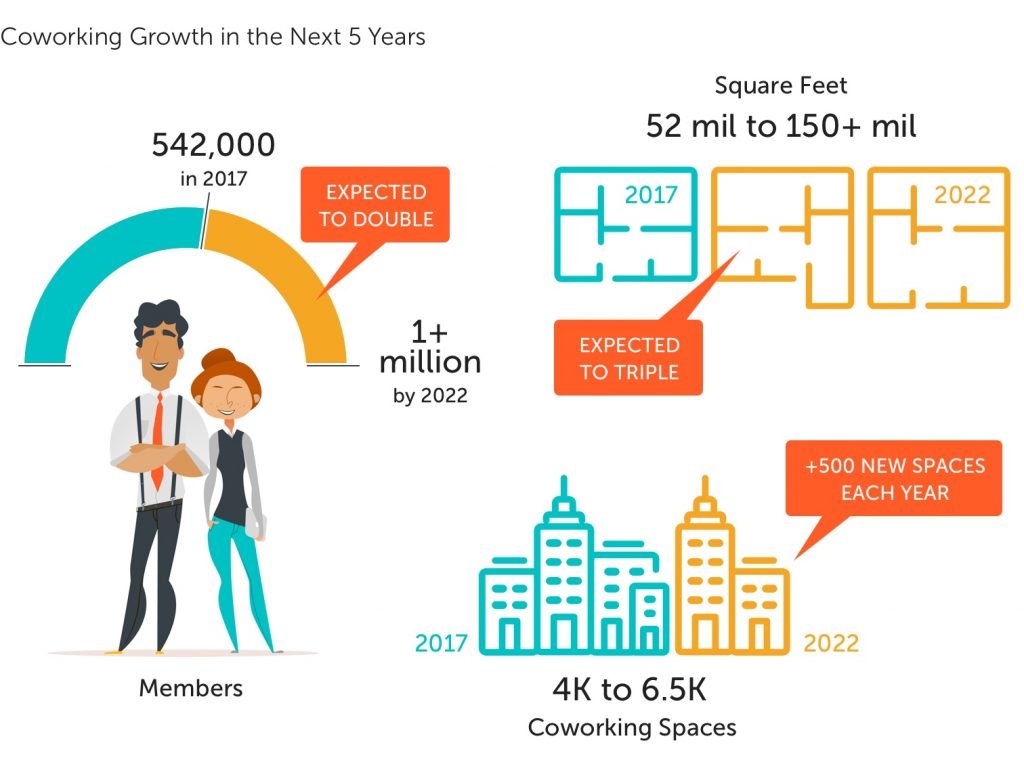

Estimates have shown a great rise in the demand for coworking space. It is to be assumed that there would be about 17,725 coworking spaces by the end of 2018 and the number of members is assumed to grow from 1.74 million in 2017 to 5.1 million in 2022.

As per the studies conducted by different sources, the amount of spaces worldwide has grown from 240% in just the past 3 years.

So considering the simple economics the coworking space on average can yield 2 to 3 times more revenue per square feet over a traditional space. The investors have known the difference in income by converting the space into coworking space.

There are 3 strategies for landlords to invest in coworking space:

- Renting out space to the coworking operators.

- Entering the market by subdividing it into different floors and self-operating the shared workspaces.

- Leveraging a step-out space to the smaller companies.

Coworking has become like a destination for various companies. So if the landlords have their building in an area that is less desired or is hard to lease, they look for existing coworking operators to lease it. This way the property owners get the benefits of the building not being used otherwise and this improves the financial performance of that particular property by bringing in more credibility.

Building a coworking space on a lease property somewhat involves certain strategies:

- Like the lower build-out cost since the coworking operators prefer to take into account a raw space and incorporate their own designs.

- The other strategy involves entering the market directly. This means leasing out the property to startup firms by offering the coworking space directly. This has the advantage for the landlords by providing the space to multiple parties. With this strategy, the landlords should be able to track down the usage so that vacancy can be estimated and optimized.

- In some cases the landlord offer discounts on rent or either takes a portion of the profits of the company.

Renting to existing coworking operators, or choosing to enter the market directly and cutting out operators is an opportunity for landlords to meet growing demand of short-term flexible leases and capture a market segment that otherwise would not fit under a traditional lease.

How has investing in a coworking space been beneficial for the property owners?

80% of the coworking operators have begun to lease their space, which removes a large upfront capital expenditure needed while purchasing a property. This also helps the coworking operator to prevent from owning a commercial real estate property and dealing with the taxes and expenses related to the maintenance.

Since the commercial building lacks vision, the property owners and building management companies continue to search for properties that are more attractive to the tenants which might turn out to be beneficial for them thereby increasing the profitability.

Building owners and building management companies continue to look for properties that are more attractive to the tenants so as to achieve higher profitability even though it can be pretty expensive to catch up when the rules are changing at such a high speed.

So let’s go back to the basics as to what matters to people, companies, and owners and it is then that proceeds to design the money-making machine.

Let’s look at the supply and demand to understand what matters to everyone:

- Owners invest so as to make money in real estate.

- Office tenants need spaces to promote business development and to have a great working environment for the employees.

- People are looking for some sort of professional and personal growth in a competitive working environment.

The benefits to the owners or landlords –

- Higher occupancy provides higher revenue.

- 3rd party partnership monetization potential through events and promotions.

- Can attract more companies thereby providing a more compelling infrastructure.

- Getting the deals closed faster thereby reducing the chances of loss.

- Become promoters of personal and professional growth to generate future leads.

However, it sometimes requires a long and taxing negotiation process with the landlords. You might have to face a spike in the rent during the renewal period as per the market rate. Even though it might seem like an intimidating offer to sign in a long-term commercial lease, the basic purpose of this is a business model is that the operator signs the lease so that the member doesn’t have to.

There is no doubt that real estate is an asset that is considered while starting a coworking space. So do your research work and deal with a broker experienced in the coworking business model, and then secure a long-term lease with favorable terms.

The rise in popularity of coworking spaces also means that real estate investors must be careful in selecting ownership in order to ensure that their spaces continue to turn over a profit.

Non-Traditional Leasing

Another common method of starting a coworking space is joint ventures. This includes combining the profit share or management fees among the landlord of the building and a coworking space operator. The benefit landlord bears here is that with this partnership he/she can bring in an experienced operator to bring flexible office options to her portfolio without having to venture outside of her core skills of owning buildings. And the benefit to the coworking space operator is that the cost of capital is covered thereby leaving the operator to develop a space that meets today’s sophisticated market demand and achieving the targeted goals.

Operators charge members of coworking space about double the amount per square foot that the operator is paying in rent to the landlord and the benefit landlord gets is a cut of the profit. Property and asset owners have acknowledged the fact that there are financial advantages to partnering with a shared workspace operator by investing in the coworking space.

The profit sharing and management agreement with the coworking spaces are becoming increasingly attractive to the landlords who appreciate the value of the commercial real estate in the coworking market.

- Profit share leases – This form of lease is prepared to protect the operator from fluctuating real estate prices and market conditions.

- Management agreements – The operators can work with property owners. Under this situation, the landlord takes care of the management fees for the shared workspace and related services within the space.

Under both the situation all the factors need to be clearly defined. An agreement must very clearly outline management or consulting fees to the operator, rent commitment, who will finance the build-out, who will fund the furniture, among other details.

Coworking spaces and their operators take many forms. The executive style office suites to niche offering in the creative segment have developed and expanded with the expansion of the market trend.

The office of the future should be designed as a manifesto that addresses the interest of all occupants, owners motivated by making a great profit, tenants seeking to become more efficient by optimizing their spaces, and occupants enjoying much more hospitable working environments.

People like to have an access to the amenities without having to incur a heavy cost. The design of the building should focus on the things that matter to the occupants. If people enjoy the resources and infrastructure it becomes like an asset to the companies.

Coworking spaces and their operators take many forms. The executive style office suites to niche offering in the creative segment have developed and expanded with the expansion of the market trend.

So this is an opinion based on some real facts about the investment to be made in coworking space.

You can share your views on the topic below in the comment box.